Typically though, taxpayers file Schedule K-1 with their individual tax returns. Therefore, depending upon the structure of your company’s business, which of these two forms would have to be distributed to all the owners, partners, or members gets determined.

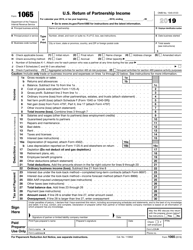

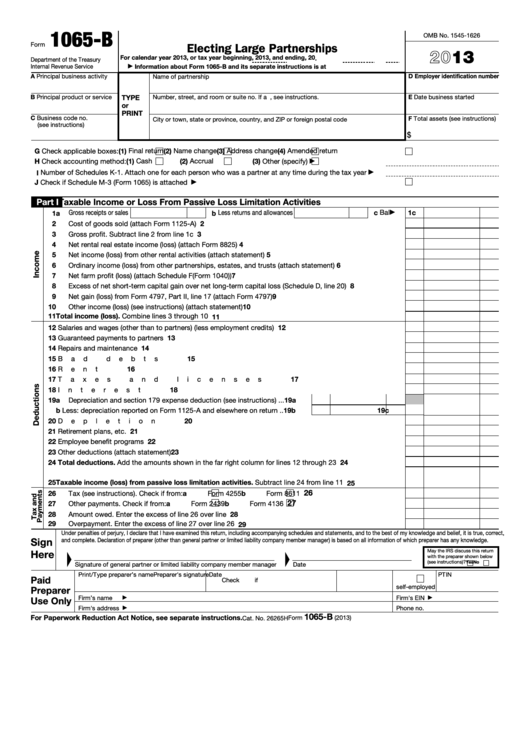

Commonly, a Schedule K-1 form is issued to those taxpayers who have invested in limited partnerships and some to those who have exchange-traded funds (ETFs), for example, those that invest in commodities. On the other hand, while a partnership in itself is not subject to income tax, individual partners, including limited partners, are liable to be taxed on their share of the partnership income irrespective of whether it was distributed or not. In fact, trusts and estates that have also distributed income to the beneficiaries will have to file Schedule K-1 forms. S corporations are companies with under 100 stockholders that are taxed as partnerships. Hence, an S Corporation reports activity on Form 1120S, while a partnership reports transactions on Form 1065.

How to File Schedule K-1 Based on Your Business Type?.This article would hence be covering the following topics to become a complete guide on Schedule K-1 and Form 1065 for you:

0 kommentar(er)

0 kommentar(er)